UK games market posts first decline in a decade as pandemic surge dissipates

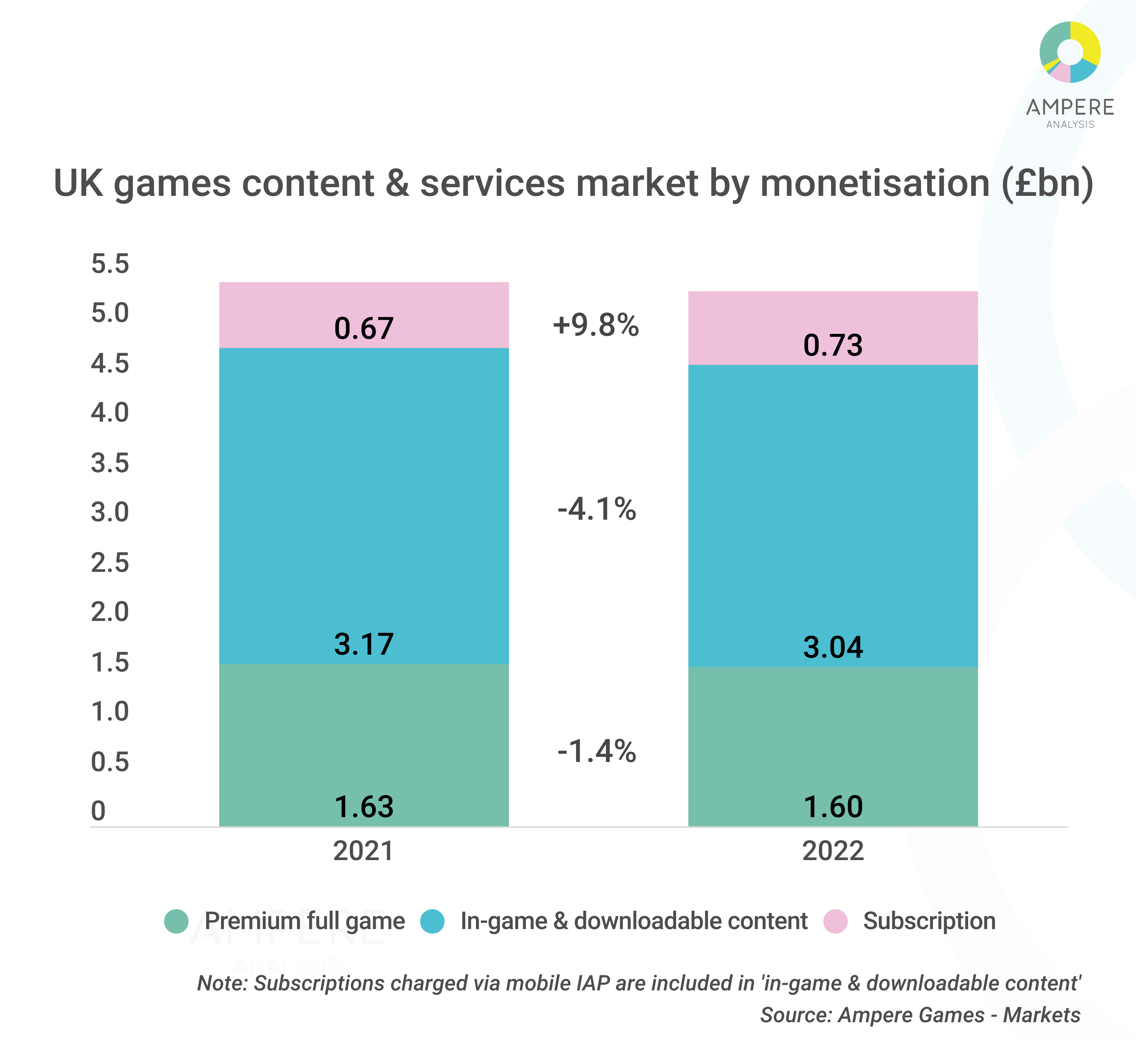

Ampere Analysis data shows that UK spending on games content and services declined in 2022 falling 1.6% to £5.38bn versus 2021 spending of £5.47bn. This is the first decline in the UK games market since 2012, yet spending remains 23% ahead of pre-pandemic levels in 2019 illustrating the significant long-tail impact the crisis has had on gaming consumption.

The global games market has experienced a series of headwinds in 2022, not least some consumption re-adjustment from the peak of the pandemic to more normalised gaming behaviour as people turn their attention to other activities. Other factors have also negatively impacted the UK market. The macroeconomic conditions and cost of living crisis will have contributed to some tailing off in games-related spending particularly towards the end of the year. Ampere Analysis data shows the biggest drop in value of spending was across in-game monetisation which will have been exacerbated by the economic backdrop, especially across more casual gamers.

The combined impact of changing consumer behaviour post-pandemic and the macroeconomic backdrop are relevant to all segments of the games market, but each device category also has additional specific factors which have delivered a mixed 2022 performance:

Mobile gaming experiences the biggest decline

Mobile gaming spending declined 3% in 2022 to £1.66bn as a post-pandemic attention deficit occurred across key demographics, including both younger (16–34-year-olds) and older (55-64-year-olds) mobile-first gamers whose gaming time decreased during the year*. The mobile games market was also specifically impacted by the changes to privacy rules across Apple iOS and the App Store, which disrupted the well-established ability of app publishers to target specific types of consumers through their mobile user acquisition campaigns. Apple’s App Store generates the major share of mobile games spending in the UK, so changes to App Store policies can resonate strongly.

This disruption was most relevant to genres of games with a narrower, enthusiast player base that require more precise targeting or for companies with less bandwidth to rapidly evolve their user acquisition strategies to match the new app rules landscape.

Console gaming market results a mixed bag

The console gaming market declined 1% in 2022 to £2.89 billion from £2.92 billion in 2021. Spending on both full games and in-game and downloadable content (DLC) declined, with in-game monetisation taking the biggest hit in value. This drop in spending was largely offset by improved subscription service monetisation: excluding subscription spending, the console market declined 3.2%.

Console games sales were dragged down by the age of Nintendo’s Switch platform, the intermittent games release schedule of the console platform companies, delays to numerous third-party titles and the ongoing lack of availability of the newest console hardware from Sony and Microsoft. While global availability of Sony’s PS5 improved in the final months of the year, stock allocation between regions was less generous to European markets and Microsoft’s Xbox Series X remained hard to keep in stock. In contrast, Xbox Series S was readily available but did not have the high-end pull of its bigger brother.

PC gaming market shows some resilience

The PC gaming market across all monetisation models, distribution channels and genre of game declined 1.2% in 2022 to £815 million from £825 million in 2021. Premium PC game sales volume declined, but the average sales price of download titles increased to help offset much of this drop. Average sales prices were boosted by several AAA titles coming to PC for the first time, including Sony’s releases of God of War and Spider-Man Remastered, and Capcom’s Monster Hunter Rise.

PC online gaming had a moderate contraction with some established service titles declining in play time and spending, and others performing more consistently. Roblox has shown consistent performance in 2022 and is a good illustration of a platform which has managed to hold on to its pandemic-based growth and is steadily broadening its appeal to a wider age group. Roblox remains an important social platform across young gamers and its PC-specific performance is helped by its lack of availability on PlayStation consoles.

Subscription monetisation grows its share of overall spending

While consumers have undoubtedly been assessing their outgoings across entertainment subscriptions more generally as the cost-of-living squeeze has become increasingly acute, the industry dynamics of the games subscription market means that spending on games subscriptions continued to grow in 2022.

Games subscription volume was down year-on-year across all services – shedding around 300k paying subscriptions by the end of 2022 – but overall spending was up, as the tiered strategies of the biggest services – Xbox Game Pass, PlayStation Plus, Nintendo Switch Online – delivered higher spending per subscription. The console platforms continue to dominate the subscription service landscape in the UK and globally, while pure-play cloud gaming services remain a tiny slither of the overall market (see first chart for almost imperceptible line at top of bars).

Note: Subscription monetisation includes console, mobile, PC and cloud games subscription services and PC games that include paid-for subscriptions. It does not include mobile games with subscriptions charged through IAPs.

*Ampere Games – Consumer research

Subscribe to receive our monthly emails delivering all the latest updates, analysis and insight from Ampere Games straight to your inbox